Ufunded: Redefining the Prop Trading Market

Ufunded has emerged as a trailblazer in transforming the prop trading landscape. Unlike traditional prop firms, Ufunded introduces an innovative approach that removes the need for demanding challenges or restrictive requirements to gain access to substantial trading funds. By focusing on simplicity and accessibility, Ufunded creates opportunities for traders without unnecessary hurdles.

Headquartered in Dubai, Ufunded operates with a team of experts who are dedicated to refining the platform and ensuring exceptional user experiences. While initially working closely with top trading education communities, UFunded has recently expanded to welcome individual traders. This shift positions Ufunded as a platform ready to meet the diverse needs of traders globally.

In this Ufunded Review, we dive into the platform's features, exploring its ufunded prices, benefits, and innovative tools. Why the world's leading educators can exclusively recommend it to their community and much more. After engaging with the Ufunded team, analyzing the platform, and speaking with its users, we present a transparent and detailed evaluation to help you decide if it aligns with your trading goals.

Why Is Ufunded Growing So Quickly?

One of the main factors driving the rapid growth of Ufunded is its strategic partnerships with some of the best European trading communities. Some of them are Tradeacademy, the largest educational community in the north of europe and tradingfreaks, one of the prime destinations for stock-related educaiton in Germany. These alliances have bolstered its reputation within professional trading networks, helping Ufunded stand out in a competitive market. Ufunded is making active steps in stepping into new markets, however again only accessible through exclusive educational communities.

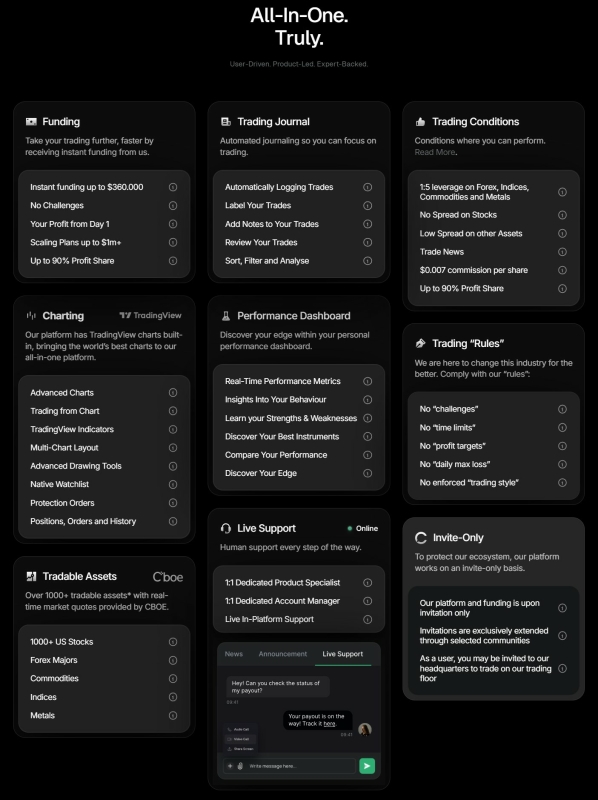

A significant addition to the platform is the integration of TradingView, the world's leading charting platform. This integration allows users to access advanced charting features, interactive tools, and data-driven insights, making Ufunded trading even more accessible and effective. While also saving it's users the additional costs of a Tradingview subscription.

Despite its rapid rise, Ufunded intentionally stayed under the radar in its early years, focusing on perfecting its systems and only choosing to work with a few handselected communities. For many traders, this may be their first introduction to Ufunded, even though it has been active within niche trading education communities for years. Now, with optimized systems and streamlined services, Ufunded is working with a selected group of partners.

Commitment to Quality and User Satisfaction

Ufunded has prioritized quality from day one, taking deliberate steps to ensure its platform is reliable and efficient. This careful approach allows the company to expand responsibly while delivering consistent service. These efforts are reflected in ufunded reviews, with users praising its functionality and responsiveness. For example, its ufunded trustpilot score of 4.6/5 highlights user satisfaction and trust in the platform.

Start today! Get a Free Demo and discover how Ufunded can elevate your trading to the next level.

In addition to excellent ratings, Ufunded emphasizes gradual growth to preserve its high standards. By expanding step-by-step, Ufunded ensures its infrastructure can support new users while maintaining the reliability that early adopters have come to expect. Even though it becomes apparent in the reviews that some users have faced platform issues in the past, however all those issues have been resolved by the team in very fast and attentive manner.

Why Traders Choose Ufunded

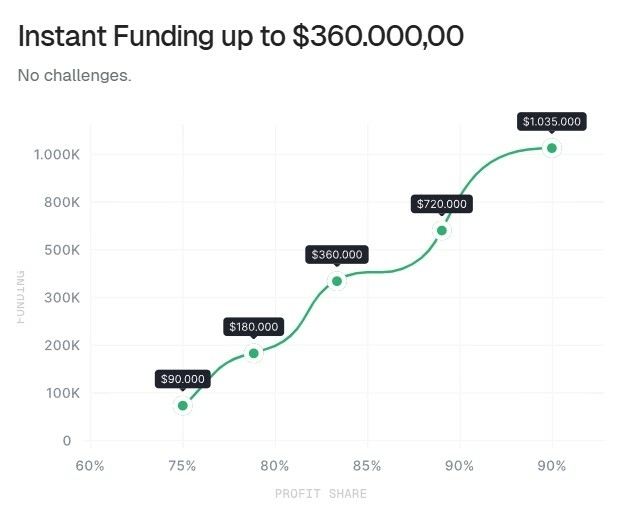

- Instant funding: Ufunded accounts provide traders with immediate access to significant trading initially up to $360.000 and later even up to 1M, eliminating traditional barriers like with FTMO or likewise company’s.

- Advanced Tools: The integration of TradingView enhances the Ufunded trading experience with cutting-edge charting and analysis features.

- Competitive Fees: With transparent ufunded prices and very competitive trading conditions (no spreads on stocks), Ufunded delivers value to both beginner and experienced traders.

- Flexible Options: A variety of funded account types allow users to choose a plan that aligns with their trading strategies and goals.

- Strong Reputation: Positive ufunded.com reviews and top ratings on platforms like ufunded trustpilot showcase the platform’s credibility.

Leverage Big Funds with Funded Accounts

One of the standout features of Ufunded is its innovative funded account system. This feature allows traders to access substantial trading funds by committing only a modest initial amount. Such flexibility gives traders the freedom to scale their strategies on a larger playing field without taking on the burden of significant financial risks.

However, trading with Ufunded accounts also comes with its own set of risks. It’s essential for traders to fully understand the mechanics of the market and develop strong strategies before using a funded account. Jumping into trading without proper knowledge or preparation can lead to significant losses, even with the benefits provided by Ufunded trading.

By combining access to funded accounts with cutting-edge analytical tools, the platform creates an all-encompassing trading solution. Whether you’re a seasoned professional or just starting out, Ufunded provides the resources and flexibility needed to execute strategies effectively and responsibly.

What Exactly Is Ufunded?

Let’s start by clarifying what Ufunded is not: it is not a broker. Instead, Ufunded functions as a trading platform, operating under different regulations compared to traditional brokers or exchanges. Positioned as a modern alternative to conventional prop firms, Ufunded introduces an innovative model designed to simplify access to significant trading funds.

The platform provides users with the opportunity to trade using funded accounts, a feature that sets it apart from traditional prop firms. Unlike those firms, Ufunded eliminates the need for strict challenges or rigid rules. New customers from their network of hand-selected educational partners can easily schedule an introductory meeting to discuss their trading goals and choose from a variety of account types, each tailored to different trading strategies. If you are not part of a trading community, you can use the link below to explore the possibilities during a demo with Ufunded.

Apply for Funding now: Schedule your Free Demo now and see how Ufunded can boost your trading!

Ufunded: A Data-Driven Platform

Ufunded has positioned itself as a data-centric company that empowers new traders to start by trading with virtual funds. Profits generated with this virtual funds are converted into real earnings and paid out. This system is backed by advanced algorithms and AI. Market data is sourced from Cboe, one of the fastest and most reliable data providers in the financial markets.

Additionally, Ufunded uses insights from successful traders’ data to support institutional clients, by sharing anonymized market intelligence. This happens entirely in the background, ensuring that Ufunded trading users remain unaffected. This innovative use of data is one of the core pillars of Ufunded's business model, making it a standout platform in the trading industry. And therefore a truly sustainable model, which allows the platform to align itself with the success of the trader.

Profit Sharing and Withdrawals

When traders generate profits, the profit-sharing percentage depends on the type of Ufunded account they have chosen (e.g., Sailor, Commander). Each account type comes with a specific profit-sharing ratio. If a trader depletes their balance, they have the option to purchase a new funded account and start trading again.

Overnight Position Limits

Ufunded trading offers users flexibility by allowing up to 100% of their funds to remain invested during the week, excluding stocks which is 20%. However, on Fridays, this limit is reduced to 20% as a precautionary measure. This policy is designed to mitigate the risks associated with weekend market closures and unpredictable price movements.

By implementing this balance between flexibility and protection, Ufunded ensures that traders can maximize opportunities while safeguarding their trading accounts from potential market volatility.

Financial Instruments and Assets

Ufunded provides access to a wide range of financial instruments and assets, including stocks, currency pairs (Forex), indices, and commodities. The platform also offers robust technical analysis tools, logbooks and intuitive charting features, enabling users to trade effectively and with confidence.

Is Ufunded a Prop Firm?

No, Ufunded is not a traditional prop firm. Instead, it defines itself as a "Neo Prop Firm." This distinction lies in its user-friendly approach, where traders are granted immediate access to funded accounts without the burden of meeting strict profit margins or completing challenging tests.

Conventional prop firms often demand unrealistically high monthly returns, which can pressure traders into making risky decisions and deviating from their trading plans. In contrast, Ufunded removes these obstacles, allowing traders to focus on executing their strategies in a stable and supportive environment. Therefore without having to rely on the downfall of the trader.

What Is a Funded Account in General?

A funded account allows traders to access larger amounts of funds than their initial deposit. This type of account provides the opportunity to trade with substantial funds in the financial markets, potentially leading to higher returns with lower initial risk. However, it also comes with increased risks that traders need to manage carefully.

Ufunded offers multiple types of funded accounts, each designed to cater to the specific needs and strategies of different traders. These accounts are designed so that users can never lose more than their initial investment, providing a secure foundation for those looking to scale their trading efforts.

While trading with larger funds can open the door to new possibilities, it’s crucial for traders to evaluate their personal financial situation and ensure they are prepared. Ufunded trading does not compel anyone to trade with significant sums but instead provides the tools and flexibility for those who are ready to take that step.

Start today! Get a Free Demo and discover how Ufunded can elevate your trading to the next level.

Is Ufunded Suitable for Beginners?

Whether Ufunded is a good fit for beginners depends on their preparation. For those with limited funds, Ufunded provides access to larger trading funds, but it’s crucial to understand the risks that come with higher funds.

Beginners should focus on mastering skills like risk management and sticking to a solid trading plan. Ufunded also offers access to educational resources on its website, helping novice traders build the necessary knowledge before trading live. While losses are capped at the cost of the account, preparation remains vital for long-term success.

Does Ufunded Offer a Demo Account?

Instead of a traditional demo account, Ufunded allows traders to start with small amounts of funds, minimizing risks while gaining practical experience. This low-stakes approach helps users familiarize themselves with the platform and test strategies in a real-world environment. With the link above you can plan a free Demo tour on the platform.

Personal Account Manager

Every Ufunded account includes a dedicated personal account manager, providing guidance and support to users. This personalized service helps traders navigate the platform, resolve issues, and gain confidence in their trading journey. It’s a standout feature that makes Ufunded trading more accessible and user-friendly than many competitors. The account manager also gives a free non-binding platform demo, in which you can get to know the unique technology, here.

Ufunded Trading Platform and Features

The Ufunded trading platform offers tools and features for both beginners and experienced traders. Through a simple dashboard, accessible via any web browser on desktop or mobile, users can easily manage trades. A key feature, Smart Insights, provides in-depth analytics to help traders improve their performance.

The platform supports trading in assets like stocks, Forex, commodities, indices, and ETFs. Backed by real-time data from CBOE, Ufunded trading ensures users can make informed decisions with accurate market information.

Key Functionalities

- TradingView Integration: Advanced charting software with customizable tools for technical analysis, suitable for both beginners and experts.

- Automated Trading Journal: Automatically logs trading activities, enabling users to back-test and refine strategies without manual effort.

- Smart Insights: Offers personalized performance data, helping traders optimize their strategies.

- Live Statistics: Real-time data from CBOE ensures precision and reliability for market decisions.

Ufunded App: Accessible Anywhere

While the Ufunded app is still in development, the platform is fully accessible via any web browser, ensuring flexibility across devices like desktops and smartphones. This approach simplifies access, allowing traders to manage accounts from anywhere.

Opening a Ufunded Account

Creating a Ufunded account is a straightforward and quick process. If you are part of one of their handselected partners, it begins with completing a simple form, followed by scheduling a meeting with a Ufunded team member. This meeting, referred to as the "Platform Demo," allows users to discuss their trading goals and preferences. During the session, the team provides a comprehensive walkthrough of the platform's features and answers any questions.

Once the demo is complete, users typically gain access to their accounts within minutes. Here’s an overview of the steps involved:

- Choose Your Account Type:

Select from the range of funded accounts offered by Ufunded, each tailored to different trading strategies and preferences. - Complete the Questionnaire:

Provide details about your trading profile, experience, investment amount, and language preferences to help Ufunded understand your needs. - Schedule Your Platform Demo:

Pick a convenient time for the demo using the online calendar. During this session, a Ufunded expert will guide you through the platform and its tools. - Make Your Purchase:

Pay for your chosen account using various methods, including iDeal, Google Pay, Apple Pay, Visa, Mastercard, or Amex. - Start Trading:

After payment, you’ll receive a confirmation email and immediate access to your funded account. From this point, you’re ready to begin trading.

Account Types and Profit Sharing

Ufunded offers several funded account types, each with unique features, costs, and profit-sharing percentages. Traders retain between 70% and 90% of their profits, depending on the account type.

If a trader reaches the maximum allowable loss, the account and open positions are automatically closed to prevent further losses. Below is an overview of the account options:

Account Type | Maximum Loss ($) | Account Size ($) | Profit Share (%) |

Sailor | 2000 | 45000 | 70 |

Commander | 4000 | 90000 | 75 |

Captain | 8000 | 180000 | 80 |

Admiral | 16000 | 360000 | 85 |

Kraken & Whale | Customizable | Customizable | Up to 90 |

Deposits and Withdrawals

Depositing funds and withdrawing profits from Ufunded accounts is a seamless process. Profit-sharing percentages are automatically calculated and applied during payouts. Transaction processing times are comparable to other platforms and depend on the type of transfer and associated banking services.

Ufunded Cost: Affordable Trading Solutions

When it comes to competitive pricing, Ufunded stands out as one of the most affordable trading platforms available. Unlike brokers or exchanges, Ufunded operates as a data-driven platform, which allows it to keep costs low for its users. This approach makes it an attractive option for traders seeking cost-effective solutions.

Competitive Pricing on Stocks

For stock trading, Ufunded prices are among the most competitive in the market. The platform charges a commission of $0.007 per share, with a minimum fee of $1.25 per transaction. Additionally, there are no spreads applied to stock trades, making Ufunded particularly appealing for equity traders who value transparent pricing.

Low Forex Spreads

Forex traders benefit from Ufunded's low spreads, which are set at 1.0 pip. This positions Ufunded as one of the more affordable options for Forex trading, especially for those who prioritize cost-efficiency in a highly competitive market.

Competitive Spreads on Precious Metals

For those trading precious metals like gold and silver, Ufunded cost remains highly competitive, with spreads as low as 1 pip. This makes Ufunded a favorable choice for traders looking to diversify their portfolios while keeping expenses under control.

Overnight Fees and Risk Management

Traders using Ufunded may encounter overnight fees, which are charged for keeping positions open beyond market hours. These fees apply to trades that are not closed within the same trading day.

Previously, Ufunded enforced a limit of 20% of the account balance for overnight positions. This meant that no more than 20% of a trader's funds could remain invested overnight, helping to mitigate risks from market fluctuations during non-trading hours.

However, this restriction has now been lifted. Traders can hold up to 100% of their funds in overnight positions, except for equities on Fridays, where the limit is reduced to 20% as an additional safeguard. This update provides greater flexibility, especially for swing traders who benefit from holding positions for longer periods. By accommodating these needs, Ufunded enables traders to utilize their funds more effectively and execute strategies without unnecessary restrictions.

Why Choose Ufunded for Low Costs?

- Transparent Pricing:Ufunded prices are straightforward and competitive, with no hidden fees or unnecessary charges.

- Low Commissions and Spreads: Across stocks, Forex, and precious metals, Ufunded cost remains among the lowest in the industry.

- Automated Risk Management: Features like the 20% overnight position limit provide additional security for traders.

Pros and Cons of Ufunded

Like any trading platform, Ufunded has its strengths and weaknesses. It’s essential to weigh these factors carefully before deciding if this platform aligns with your trading needs. Below, we provide a clear overview of the key advantages and drawbacks of Ufunded. For the latest updates and in-depth comparisons, we recommend checking the comparison page on the Ufunded website.

Advantages of Ufunded

- Access to Funded Accounts: Traders gain immediate access to funded accounts without the need to complete challenges or adhere to strict rules.

- Wide Range of Assets: Includes stocks, Forex, commodities, and index funds.

- Beginner- and Expert-Friendly: Suitable for both novice and experienced traders.

- Trading Platform, Not a Broker: Operates under different regulations, offering greater flexibility.

- Free TradingView Integration: Advanced charting tools included at no additional cost.

- Neo Prop Firm: A modern approach to prop trading, eliminating traditional challenges.

- Trustpilot Rating: A solid score of 4.6, reflecting user satisfaction.

- Low Costs: Competitive pricing on commissions and spreads.

- Diverse Account Types: Multiple options tailored to different trading needs.

- Active Customer Support: Quick and solution-oriented assistance with excellent accessibility.

- Convenient Payment Options: Supports a variety of methods for deposits to purchase an account.

- Educational Partnerships: Collaborates with major trading education communities in Europe and soon also other continents.

Disadvantages of Ufunded

- Not Registered with a Regulator: Ufunded is not registered with a financial regulator as it operates as a trading platform, not a broker or exchange.

- Funded Account Risks: Trading with funded accounts involves inherent risks, making preparation and risk management essential.

- Accessibele: Only accessible through educators.

- Costs: more expensive than traditional challenge based firm.

Why Consider Ufunded?

Ufunded combines innovative features, cost-effective solutions, and accessibility, making it a strong contender in the trading platform market. However, it’s important to understand the risks involved with funded accounts and ensure proper knowledge before trading.

For those seeking a modern prop trading platform with minimal barriers to entry, Ufunded offers a unique opportunity to grow trading strategies without traditional restrictions.

Start today! Get a Free Demo and discover how Ufunded can elevate your trading to the next level.